While challenges with liquidity issues have buffeted the lending landscape, it still warrants a thoughtful strategy for success in the coming year. As you look ahead to what will likely be a challenging market, more discernment and targeted programming will be necessary.

Consumer lending trends for 2023 show:

• Cost of lending increasing for the consumer – Rate increases have made purchases for more expensive items like autos and homes out of reach. Consumers are now unable to qualify for many loans.

• Cost per loan increasing for the institution – According to the Federal Reserve, automotive lender rejection rates grew from 9.1% in February to 14.2% in June. This spike illustrates how quickly economic factors can impact credit access. Credit bureau service costs have also increased, making writing each successful loan more costly.

The economic impact of general softening follows the basic law of supply and demand. The prices of loans have increased, and the demand for items that are the beneficiaries of those loans has decreased. This is borne out by information from PSCU that shows consumer purchases softened in October, and the rate of growth continued to diminish to the lowest point of 2023.

This trend is expected to persist through 2024 and may take 2-3 years to normalize.

How will this impact 2024 marketing?

With demand falling, companies may instinctively cut marketing investments. You want to advocate for a commitment to marketing in these times, as it is often a chance to grow market share.

Biota Li MacDonald, Director of Marketing Strategy at Compremedia, contends their research supports increased marketing investment and showed the following consumer reactions to marketing during this downturn:

• 29% Researched a product or service online

• 20% Clicked on a social media ad

• 18% Responded to an email offer

• 16% Responded to a direct mail product offer

• 16% Followed a company on social media

As you can see, these consumer actions above are not from organic efforts. They come from a planned schedule of intentional marketing campaigns.

Encourage a balanced approach with 2024 lending marketing initiatives.

Maintain a strong marketing foundation in the coming year. However, ensure your efforts and marketing spending align with the current mix of lending opportunities. For instance, data shows that mortgage lending is down, and personal loans are up.

Think in terms of acquisition and optimization to grow your entire lending portfolio.

Acquisition efforts can be externally focused, reaching out to the marketplace for new lending dollars. Think of these efforts as pursuing new money for auto and personal loans from both new and existing consumers.

As suggested above, you want to use targeted media:

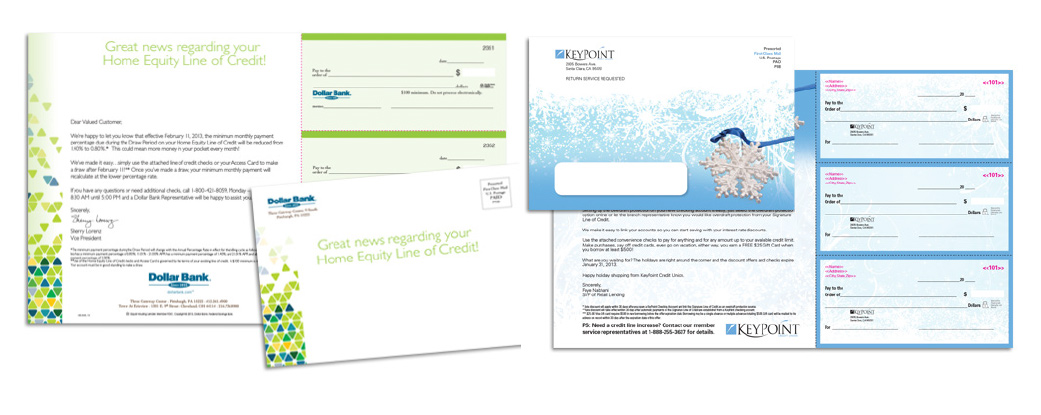

• Highly personalized and targeted direct mail with digital response options (QR codes).

• Personalized emails with splash page fulfillment.

• Social media ads around complementary products and lifestyle pages.

Because the lending space is very competitive, you also want to ensure each lead successfully moves through to closing. Consider additional staff follow-up for each loan lead.

Optimization efforts are funds/revenues secured through internal means. For instance, moving a consumer to a more profitable product. Focusing on these incremental optimization efforts during more difficult times can help you improve your overall business and build increased consumer account depth.

Work closely with your data and product teams to identify where there may be opportunities for improvement. Then, reach out to these consumers with email, direct mail, and personal calls to present these options.

The industry is in a challenging place going into the next year. If you need a ready partner for all things marketing, consider your friends at Westamerica. We exist to help you grow!

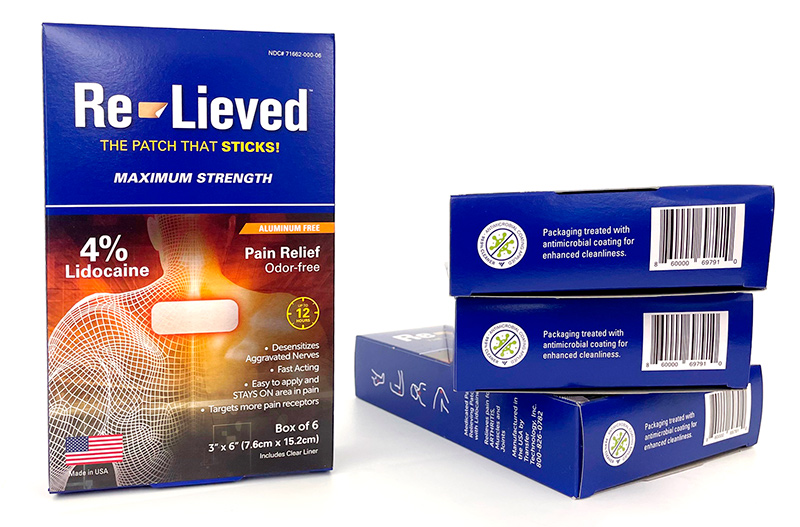

Westamerica has developed support materials to help customers communicate their use of the new coating on any of the products that consumers may interact with. A dedicated web-site,

Westamerica has developed support materials to help customers communicate their use of the new coating on any of the products that consumers may interact with. A dedicated web-site,  As the US opens up for business once again following the COVID-19 Pandemic and stay-at-home social distancing recommendations lift from coast to coast, the first “post-pandemic” consumers might be arriving in your businesses soon.

As the US opens up for business once again following the COVID-19 Pandemic and stay-at-home social distancing recommendations lift from coast to coast, the first “post-pandemic” consumers might be arriving in your businesses soon.  Retailers have had a mixed response to social distancing protocols. Some have enforced masks; others choose to let their customers decide.

Retailers have had a mixed response to social distancing protocols. Some have enforced masks; others choose to let their customers decide.  Amazon, like Costco, requires their team members and customers to wear masks at Whole Foods Market stores. However, they also offer free disposable masks to all Whole Foods Market customers to any customers who did not bring a face covering with them.

Amazon, like Costco, requires their team members and customers to wear masks at Whole Foods Market stores. However, they also offer free disposable masks to all Whole Foods Market customers to any customers who did not bring a face covering with them. How these brands will enforce their policies is likely to vary from location to location. One California Costco location had masks available to members who didn’t have them, but that is not to say all sites do. Amazon says they will have them available, along with other COVID-19 precautions.

How these brands will enforce their policies is likely to vary from location to location. One California Costco location had masks available to members who didn’t have them, but that is not to say all sites do. Amazon says they will have them available, along with other COVID-19 precautions.  However, other retailers across the country have experienced unfortunate optics on the enforcement of the face-covering recommendation or requirements.

However, other retailers across the country have experienced unfortunate optics on the enforcement of the face-covering recommendation or requirements.  Some exchanges reported by The NY Times are more violent. A Target employee in Van Nuys, CA, broke his arm escorting customers refusing to wear a mask out of the store. A cashier in Perkasie, PA, was punched in the face three times after refusing to sell cigars to a customer without a mask. In San Antonio, TX, a man who could not ride the bus without a face cover shot another passenger.

Some exchanges reported by The NY Times are more violent. A Target employee in Van Nuys, CA, broke his arm escorting customers refusing to wear a mask out of the store. A cashier in Perkasie, PA, was punched in the face three times after refusing to sell cigars to a customer without a mask. In San Antonio, TX, a man who could not ride the bus without a face cover shot another passenger.

Westamerica Communications is the new spirit of communications with creative solutions for every form of media, from web strategies to traditional concepts to print and mail options, and more. Follow us on

Westamerica Communications is the new spirit of communications with creative solutions for every form of media, from web strategies to traditional concepts to print and mail options, and more. Follow us on

Our employee health and safety is our number one priority. We’ve taken extensive steps to keep our employees safely out of harm’s way, including the following key processes:

Our employee health and safety is our number one priority. We’ve taken extensive steps to keep our employees safely out of harm’s way, including the following key processes: