Mobile is still booming. People now spend more time on their smartphones than on their desktops and laptops combined. And the gap is widening. We are now officially past the smartphone tipping point. Now that users are in the mobile world, how do we get them into our mobile world? Here are a few tips to encourage them to download and use your mobile banking app.

Mobile is still booming. People now spend more time on their smartphones than on their desktops and laptops combined. And the gap is widening. We are now officially past the smartphone tipping point. Now that users are in the mobile world, how do we get them into our mobile world? Here are a few tips to encourage them to download and use your mobile banking app.

Tip #1 — Keep it simple

Work with your IT team from the very beginning to make the process of downloading and using your banking app as painless as walking into one of your branches and opening up a checking account. On the other end of the process, train your in-branch team members as well as your online and telephone helpline staff on guiding your users through downloading and setting up your app.

These associates should know everything about this process just like they are expected to know everything about the other products you offer. The people jumping into a mobile banking app at this point aren’t exactly early adopters. They’ll need a little technology hand holding, and the financial institutions that do that will capture this end of the adoption bell curve.

Tip #2 — Get them watching

We all know how much it costs to process a check deposit at the branch level. If we can get our customers to utilize mobile bank deposits, we’ll be able to provide a more convenient service for a fraction of the price.

Enter video tutorials. By creating an easy-to-view, easy-to-follow video on how to deposit checks with your phone, you will send adoption rates soaring and ease up on all the time consumers spend on customer helplines.The phrase “Content is King” has run its course and is now about as trite and worn out as “You go girl”. But it became a cliche’ for a reason. And video content is the perfect way to train your new user on how to utilize their handy dandy new mobile app.

Tip #3 — Use every option

This moment is the perfect chance to leverage every marketing channel you have. When you launch an app shout it from every marketing rooftop you can find. Make sure you hit them with the formats they are most familiar with and then branch out to make a splash. After your launch, don’t abandon your promotion. Too many marketers make this mistake. Support your application with continuous marketing support.

Tip #4 — Keep it digital

By reaching out to your base with your digital channels, you’re one step closer to application download and adoption. Carve out a consistent and noticeable spot on your banking home page and use it to drive your customers to mobile. Use your social channels to promote the release of the app and then gently remind your audience of the mobile banking advantages.

Tip #5 — Don’t forget email

Recent studies have shown that 49% of all emails are now opened on mobile devices. In this particular case, your email list is very useful because email from your financial institution gets opened. Once your customers do open your email make sure it’s mobile-friendly. Also, make sure there are direct links to the most popular app stores — iTunes and Google Play. Finally, make sure you’re tagging these links for tracking and analytics.

Tip #6 — Include snail mail

Yes, as outdated as this might sound, consider the audience. Reaching the percentage of your customers who have yet to start using your mobile banking app through a more traditional form of communication makes a lot of sense. Nothing crazy or flashy is required. Something as simple as a statement stuffer might work wonders and, at the very least, be a solid reinforcement of your message. For these reasons, this traditional form of advertising still has a useful place in your campaign.

Tip #7 — The human touch

What better place than your branch to walk people through downloading and using an app? If a member of your staff can make the life of a customer easier and more convenient, you’ve hit a home run. The branch is also a great place to promote your mobile banking with signage and collateral.

To sum it all up, the best branch your customer could have may not be a branch at all. The idea of banking convenience is being redefined one smartphone at a time. Get them to use your app and you’ve deepened the relationship that leads to a customer for life.

Keeping Track — ROI measurement tools to better assess your marketing

Advertising legend has it that in 1951 many major cities began to experience a massive loss in water pressure at the same time on the same night of the week. After studying this odd phenomenon, a wise water department official soon made the connection.

It was The Lucy Show.

The red-haired comedianne was so popular that nearly the entire city was quickly going to the bathroom and flushing their collective toilets all at the same time. And tracking advertising effectiveness (or lack thereof if your commercial ran at the beginning of the break) was born.

Oh, how things have changed! Gone are the Mad Men days of throwing a message out into the vast semi-empty world and waiting with bated breath to see if sales somehow magically went up. It was a golden era when marketing wasn’t trackable and in turn, marketers weren’t completely responsible. Media buying was less about direct results and more of a “spray and pray” discipline.

Define ROI? These guys couldn’t spell ROI.

You, on the other hand, market in a world where you need to show a substantial return on nearly every dollar.

Here are five tips that will help you become a more effective marketer:

- Plan ahead. Put measurement into your marketing plan from the start. It’s vital and will help you make many of your channel decisions. And add a channel hierarchy into your plan. When you have multiple channels working together, the analytics on each channel can be blurred. But they should be. That means that your efforts aren’t siloed. Just manage those expectations in your plan with a clear channel hierarchy.

- Use control groups. To determine true results, you’ll need to create a control group. With the growth of multi-channel digital marketing, this can be a difficult endeavor, but it’s worth the effort. Without a control group, your results can easily be criticized. Credit for success can be given to other outside events beyond your marketing’s influence. With solid marketing planning and campaign management tools, you can create and maintain a pure control group that will in turn maintain the integrity of your results.

- Define your metrics. To gain a more accurate measurement of your marketing be sure to define the metrics of your successes. This step seems elementary, but when the metrics aren’t well defined, marketing results can be seen as “fuzzy”. Your results, on the other hand, need to be crystal clear. Making sure your metrics are defined and well communicated to all stakeholders will get you the detailed measurements your well-spent money deserves.

- Give credit per channel. Each channel should have its set of measurements for the simple reason that every channel is different. So make the rules different. Rolling out a campaign means that certain channels will get the credit for a first impression, and other channels may get credit for a sale. They all work together but manage the results by the different definitions of success that each different channel will have.

- Manage and communicate the results. With all the pieces of communication going out and the massive amounts of information from your analytics coming in, it may feel like you’re trying to drink from a fire hose. Automation is the key. Leverage the many great tools out there to automate your information gathering. Then make sure your results are effectively distilled and expertly communicated.

The numbers from your findings won’t mean a lot if they can’t be properly digested. Visual representation of your results through dynamic graphs and infographics will make your results shine. They will also make your findings easier to understand.

And there you are. By creating a plan, using control groups, metrics, separation and automation you can garner effective measurement ROI for your marketing. This practice is part art and part science. The more experience you have analyzing your results, the more accurate your results will be.

The opportunities are out there. By tracking the channels that lead to a successful sale, you’ll ensure your marketing is working. By making decisions and changes based off your analytics, you’ll be able to speak to the right person at the right time with the right message.

And that is the ultimate goal of all effective marketing.

One of the largest generations in history, millennials, is about to move into their prime spending years. How best can you get your products and services in front of the millennial generation?

One of the largest generations in history, millennials, is about to move into their prime spending years. How best can you get your products and services in front of the millennial generation? uncommon for millennials to use multiple tech devices. “87% of millennials use between two and three tech devices at least once on a daily basis.” Perhaps this is why millennials are always pictured with a mobile device in their hand.

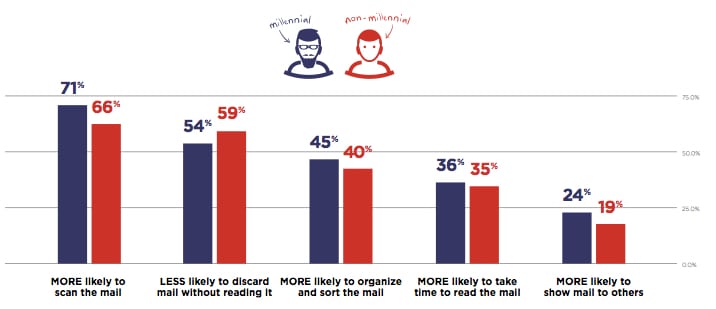

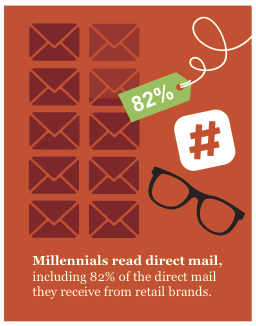

uncommon for millennials to use multiple tech devices. “87% of millennials use between two and three tech devices at least once on a daily basis.” Perhaps this is why millennials are always pictured with a mobile device in their hand. A 2016 USPS Marketing White Paper reported that:

A 2016 USPS Marketing White Paper reported that: