One of the largest generations in history, millennials, is about to move into their prime spending years. How best can you get your products and services in front of the millennial generation?

One of the largest generations in history, millennials, is about to move into their prime spending years. How best can you get your products and services in front of the millennial generation?

When most people think of millennials they think digital. According to Forbes, it is not  uncommon for millennials to use multiple tech devices. “87% of millennials use between two and three tech devices at least once on a daily basis.” Perhaps this is why millennials are always pictured with a mobile device in their hand.

uncommon for millennials to use multiple tech devices. “87% of millennials use between two and three tech devices at least once on a daily basis.” Perhaps this is why millennials are always pictured with a mobile device in their hand.

With an estimated $200 billion in annually spending and more than $10 trillion during their lifetimes, millennials are the “holy grail” of consumers.

Determining the Best Marketing Channel

There are a number of marketing channels that can be used to reach customers. Online video, social media, and email are channels that seem best suited for an “online” digital generation. But traditional marketing channels should not be ignored. In fact, research show that millennials react better to traditional forms of marketing, like direct mail, than to online electronic marketing.

A 2016 USPS Marketing White Paper reported that:

A 2016 USPS Marketing White Paper reported that:

- 84% of Millennials take the time to look through their mail

- 64% would rather scan for useful info in the mail than email

- 77% of Millennials pay attention to direct mail advertising

- 90% of Millennials think direct mail advertising is reliable

And when it comes to marketing and purchases:

- 82% read direct mail they receive from retail brands

- 57% have made purchases based on direct mail offers

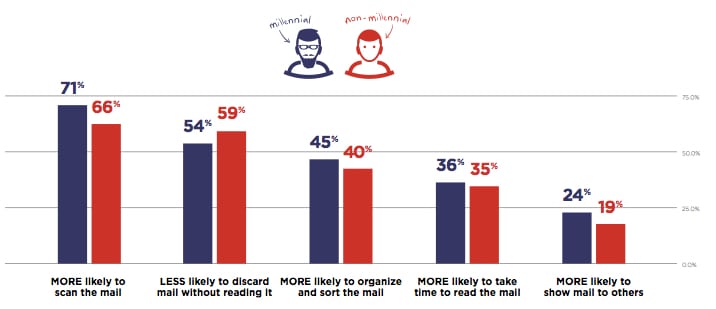

The chart below demonstrates that despite their digital appearance, millennials read, open and interact with direct mail.

The Top 200 Direct Mail Service Providers

Direct mail gets your message in the door and into the consumer’s hand, where it can be seen, read, and felt and generate a response! That’s why a big part of what we do is focused on direct marketing. In fact, it’s so big we’ve just been named to the Bell & Howell Top 200 Direct Mail Service Providers list for 2017.

The reason direct mail works for millennials, and all other generations, is simple. As Nabeel Jaitapker, Senior Communications and Marketing Manager, Content Development and Demand Generation at Bell and Howell stated, “Direct mail marketing is getting more personal, more real, and more effective thanks to affordable high-quality digital printing and technologies that simplify integration into a multi-channel campaign.”

The USPS White Paper highlights some of the new technologies that can engage millennials with direct mail. They include:

- Incorporate multimedia and digital: Embed QR Code® barcodes, near field communication, or augmented reality to link your mailer to video and interactive materials on your website or social media sites.

- Keep your messaging succinct and easy to read. Provide bite-size pieces of information.

- Be authentic. Millennials distrust traditional advertising, so avoid hard-sell language. Use a straightforward, transparent approach.

- Use enhancements such as scent, sound, or texture to make your piece stand out.

- Help them feel good about their purchase. Millennials are compassionate and want to improve their world. Campaigns that donate a percentage of profits to a worthy cause or in some other way demonstrate corporate responsibility can resonate—if they’re seen as authentic.

- Use slang with caution, even if you are a Millennial. You risk turning your audience.

When you’re looking to engage millennials, or any other generation, you need a variety of proven marketing channels. A direct marketing campaign that includes mail, video, email and social media, is sure to accomplish your goal.