How can a credit union differentiate itself from other financial institutions? The truth is, there’s any number of ways for a person with good credit to secure a loan. Major banks and online lenders offer loans with excellent rates. Thus simply having a good rate will not separate one lender from the next.

One of Westamerica’s clients in Pennsylvania found itself in this exact situation. Merck, Sharp, & Dohme Federal Credit Union (MSDFCU) needed a way to connect with its members that went beyond traditional ways of marketing.

Traditionally, credit unions, like most financial institutions, promote the low rates they offer as a way to entice members to apply and secure a loan. MSDFCU, with the help of the team at Westamerica Communications, took a different path.

People Helping People

Credit unions are not-for-profit financial cooperatives ran by members, not customers.

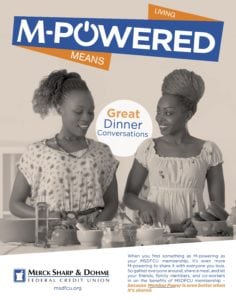

The goal of the marketing plan was to place a larger focus on the qualitative benefits that MSDFCU provides. The campaign promoted and developed a stronger emotional appeal built on members helping members. The idea was to create a feeling of “peer-to-peer” lending and a stronger display of ‘how can we help you.’ In this way, the campaign reframes how the membership thinks of the credit union and keeps them top of mind.

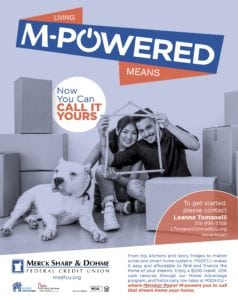

The team at Westamerica developed marketing materials demonstrating that the credit union could be a financial partner for every part of a member’s life. We did this by focusing on four main financial solutions, including home equity lines of credit, mortgages, auto loans, and credit card balances.

The M-Powered Solution

Our creative team concentrated their efforts on a mix of traditional and online marketing materials including pre-approved direct mail letters, follow-up postcards, in-branch point of purchase displays, email, web graphics, and print ads. In this way, the campaign would reach the MSDFCU membership at every touchpoint and reinforce the message no matter where or how the membership interacted with the credit union.

Our creative team concentrated their efforts on a mix of traditional and online marketing materials including pre-approved direct mail letters, follow-up postcards, in-branch point of purchase displays, email, web graphics, and print ads. In this way, the campaign would reach the MSDFCU membership at every touchpoint and reinforce the message no matter where or how the membership interacted with the credit union.

The original design was used for the first campaign in the second quarter of the year. Then the ads were repurposed for use in the following two quarters. All of these materials carried the same theme, Members Power us to M-power you.

This innovative branding strategy of a full year of quarterly promotions based on a single design served as a cost savings measure for the MSDFCU

The M-Powered Campaign Results

The results of the first campaign of the year were impressive. MSDFCU reports an ROI of over 600%. Due to the new marketing campaign, they closed over 70 loans in the second quarter of 2017 totaling more than $4 million. This represents a 49% increase over their 2016 campaign.

The results of this yearlong campaign show that credit unions can differentiate themselves from other financial institutions. By highlighting their unique characteristics. They should promote the fact that they are a community-driven organization. Made up of members helping one another. This builds a strong emotional connection between the members and the credit union.