A big focus of major firms today is the question of “Fintech” and how to either better compete with a digital-only provider or how to integrate a timesaving, consumer-friendly financial services platform into your traditional financial services business.

A big focus of major firms today is the question of “Fintech” and how to either better compete with a digital-only provider or how to integrate a timesaving, consumer-friendly financial services platform into your traditional financial services business.

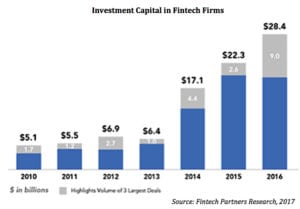

Fintech is a modern day gold rush. The investment capital into the Fintech space continues to grow.

Consumer Digital Solutions –Predominantly High Tech; Low Touch

We know that for most digital transactions, consumers like the efficiency and convenience that are at their fingertips. Simple transactions like picking out groceries, or ordering from a menu really don’t require a heavy lift. We have even become comfortable buying airline tickets, and reserving and paying for hotel rooms and rental cars from the convenience of a website or app.

But What About Financial Services?

From the time that the ATM was introduced in 1969, financial firms embraced technology that extended their service capability and provided user convenience. Today there are over 3.5 Million ATMs worldwide. The ATM replaced the fairly simple activity of withdrawing money from your account, making deposits and simple transfers. These lower-complexity transactions were high tech and low touch, a winning combination for something so straightforward.

In fact, the cast of Saturday Night Live parodied the triviality of bank transactions in the classic comedy spot, “CitiWide Change Bank.”

Click below to see this classic spot:

Winning Fintech Solutions – High Tech; High Touch

As the range of Fintech solutions grows, the barrier to market success will come from trying to solve problems that fail to take into account the human side of this equation. A high tech, high touch service platform will be necessary for those transactions that require conversation, consultation, and coordination with a knowledgeable individual.

Our Experience in a Digital Lending Platform

Over the past nine years, our firm has partnered with a Fintech firm, CUneXus to deliver consumer-lending solutions to the financial industry. This platform is now installed in 65 firms throughout the US at institutions sized from $250MM to an excess of $10B.

In the early stages of The Loan Generator, we identified several things that needed to happen for adoption:

- Consumers needed to be educated on the new tools that were available (allowing them to select from pre-approved loan offers)

- Consumers needed an explanation on how to interact with this new process

- Consumers needed to have ready access to support staff to assist in completing the transaction

With our model, after the completion of the transaction (high tech), the consumer identified the time and method for a follow-up call with the representative (high touch).

In some cases of high-transaction products like credit cards where consumers understand the product and the process more clearly, very little consumer follow up interaction takes place (low touch).

The Role of Human Capital in Fintech Evolution

While we can see that simple transaction activity, like making change, deposits, and even some loans will not require highly-skilled back-end support, other solutions will. Using our experience with the Loan Generator System we have found that there are two primary benefits that have been delivered to those that use our platform: Incremental Loan Volume and Profits, and Streamlined Loan Processing.

This has been accomplished with little impact on headcount.

It appears that the net impact on the number of people has not changed. The efficiency of the program combined with the volume increases has been a net wash on the human side of the equation.

The program drives loan profit without adding support staff.

However, it does mean that the people now supporting the program will have to learn some new skills in conjunction with the changing environment. For instance, processors might now be talking about their consumer’s current lending offer but may also be asked about the other loans that are available to them. They now may need to be able to discuss these options and alternatives more consultatively and with a front-facing mindset than in the past. In this model, we bypass the loan officer and direct the fulfillment efforts right down to the processor.

While we may be reducing the in-person connection at the start of the loan process, the process itself can continue to be highly consultative and supportive as needed. Different loans will require different levels of support. And, different consumers will likely have a greater reliance on available support.

While we may be reducing the in-person connection at the start of the loan process, the process itself can continue to be highly consultative and supportive as needed. Different loans will require different levels of support. And, different consumers will likely have a greater reliance on available support.

Any Fintech solution should be flexible enough to provide this capability.

You should expect that some technology solutions will save you both labor costs and deliver transaction savings. However, you should also strive to maintain the important personal (high touch) links and relationships that you have with your consumer and train your people accordingly.

To do otherwise will only push them to your competitors.