When you are in the middle of a pandemic, the last thing you likely want to do is add debt onto an already unstable situation. And certainly not onto your primary living space. So was the thinking in 2020 according to the Mortgage Bankers Association. Home equity loan debt declined in 2019 and was projected to do the same in 2020.

However, with the rapid appreciation of home pricing during this past year, and the pandemic seeming to be on the downhill of its peak, homeowners may now be ready to tap into the equity opportunity that exists.

In fact, estimates are as high as a 10+ percentage growth rate for home equity lending volume.

What’s Fueling this Positive Outlook?

The lowering of mortgage rates earlier in 2020 increased demand for first mortgages, refinancing and new home purchases. The resulting impact meant home prices grew at double digit rates stemming from large amounts of buyers and not enough sellers. Basic supply and demand.

The Current Equity Market

According to CoreLogic, U.S. homeowners with mortgages have seen their equity increase by a total of $1 trillion since the third quarter of 2019, an increase of 10.8%, year over year. The average homeowner has approximately $200,000 of home equity.

The question becomes how to help the homeowner unlock this equity to use in a productive manner meeting their financial and lifestyle requirements.

Marketing Home Equity Loans

To generate the greatest success in home equity lending, several key promotional strategies should be employed.

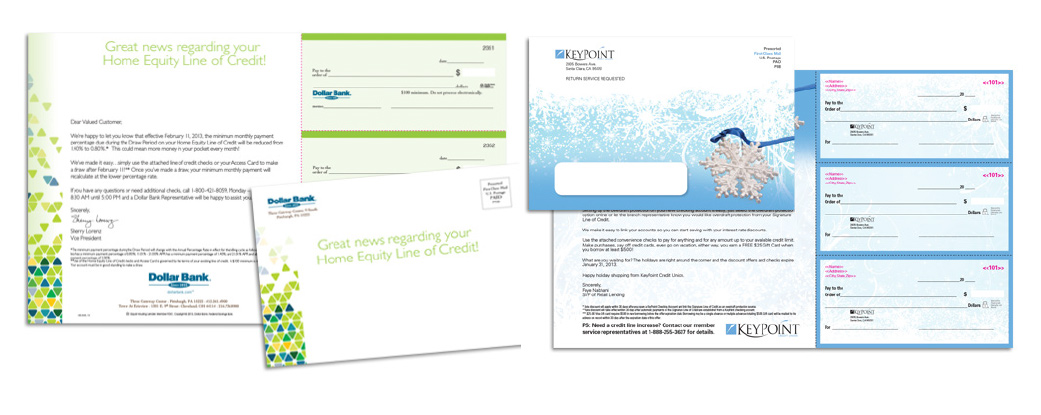

1) Create a comprehensive integrated awareness campaign

This leverages all forms of digital and print merchandising to call attention to your rates, terms and service advantages. Build an effective theme to use as an umbrella and support it with impactful copy and messaging.

2) Implement targeted direct mail to highly targeted and focused outbound mailing.

The market for home equity loans will be heating up in 2021. Make sure to promote early and often to ensure that you secure your fair share of this large and growing segment.

3) Activate existing home equity lines of credit

Use a lettercheck campaign to encourage existing account holders to tap into their credit lines. The checks offer immediate results and convenience.

The market for home equity loans will be heating up in 2021. Make sure to promote early and often to ensure that you secure your fair share of this large and growing segment.

Need help? Contact your Westamerica representative or click here